What's Below in Issue #61:

📰 - A look into what founders need to know about new CTA reporting requirements

📊 - Data behind the shrinking cash raised per round

🎙️- Podcast w/ Kaustav Das

💵- Premium startup resources

🆓- Free startup resources

-------------------------------------------------------------------------------------------------------------------------------------------------------------

![]()

New Government Law Could Cost You $500/Day!?

Congress passed the Corporate Transparency Act (CTA), and now qualifying businesses must submit a Beneficial Ownership Information Report or be subject to government fines up to $10,000 or $500/day with potential jail time.

It's a harsh punishment, but we've partnered with BOI Zen to make it easy to get compliant and stay compliant to avoid the government from taking your fresh capital.

You'll never have to worry about getting fined with our friends at BOI Zen

------------------------------------------------------------------------------------------------------------------------------------------------------------CTA Legal Jargon Translated

If you’re a founder, you probably have heard all about the Corporate Transparency Act (CTA). The problem (unless you are a trained lawyer) is that all the articles online are a bunch of legal jargon. We are here to help.

First a disclaimer: This article is intended for general informational purposes only and is not intended as legal advice on any matter. Do not act or refrain from acting on the basis of any of the content in this article. This article is current only as of February 19, 2024 and will not be updated for any changes in law occurring after such date. PLEASE CONTACT AN ATTORNEY FOR SPECIFIC DETAILS.

The legislation was passed in 2021 to fight the use of anonymous shell corporations that are at times used for money laundering, tax evasion, and funding terrorism. In March 2023, the Small Business Administration (SBA) reported that 27,104,006 (81.7%) of small businesses have no paid employees! The new reporting requirements will allow for oversight into who owns and controls these entities.

To summarize the rule in a single sentence: small companies are required to report to the government who has control and ownership.

Now for the details.

Who needs to file?

Almost EVERY startup reading this newsletter will need to comply with these new reporting standards. There are a few exceptions (including certain non-profits and pre-revenue situations). If you are unsure about your specific type of corporate structure, be sure to ask a lawyer.

In general, if you have any of the following, you WILL be required to report to FinCEN:

- less than 25 employees

- no physical office location

- OR less than $5M in gross sales

If you can surpass ALL those conditions, then you will likely be exempt from the reporting requirements.

When do you need to file?

Any corporation started (and registered) before 2024 has the entire 2024 calendar year to complete the filing (no rush yet). However, if your company was started after the New Year, then you have 90 days to complete that filing.

UPDATES! This is critical to know. If there is a change or an error in the filing, it must be updated within 30 days!!! This includes:

- Someone moved to a new home

- A new person is hired to the C-Suite (or similar position – talk to your lawyer)

- A new passport or ID is issued with a new number

Yes, this is the difficult part and crucial for you to stay in compliance with.

What needs to be done?

The filing can be completed on the FinCEN website: https://www.fincen.gov/boi

or you can get compliant with our friends at BOIzen.co

They will ask you for the following information:

- Beneficial owners. These are people who exercise substantial control over the company (either direct or indirect) OR own/control 25% or more of the ownership interest.

- Company applicant. The person (or people) who file the document that creates the domestic reporting company and those who are primarily responsible for directing the filings.

- Company applying.

For each of the above people you will need:

- Full legal name

- Date of birth

- Street address (residential street address for individuals)

- Unique identifying number and the issuing jurisdiction from either a current (i) U.S. passport, (ii) state or local ID, (iii) driver’s license, or (iv) foreign passport

- Image of the document used for part 4 above.

For your company, you will need:

- Startup legal name and any trade names

- US address

- State (or country) of incorporation

- Tax identification numbers

Another option for individuals is to file their information directly with FinCEN and receive a FinCEN ID number which can be used in the company filings.

What if I don’t comply?

Please do. The punishments are quite harsh. The civil penalties include a fine of $500 for each day that the violation continues (up to $10,000), or criminal penalties, including imprisonment for up to two years.

We strongly encourage our readers to read more about the Corporate Transparency Act and contact an attorney if they have any questions.

Relevant Articles to CTA Reporting

- The Corporate Transparency Act (CTA) - 👉 IACA

- The Corporate Transparency Act: What Startups Need to Know About Compliance - 👉 UChicago Law

- Beneficial Ownership Information Reporting FAQ - 👉 FinCEN

-------------------------------------------------------------------------------------------------------------------------------------------------------------Data Corner

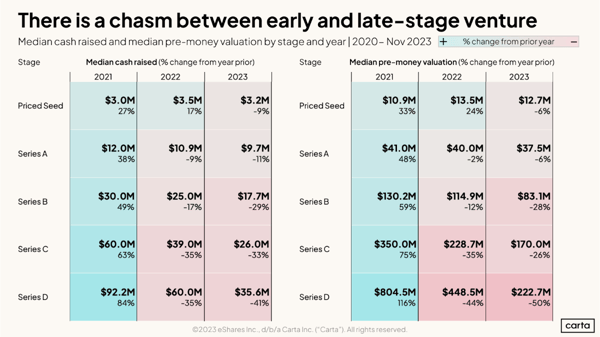

Cash Raised By Stage Drops

Last year we saw the second year of valuations and cash raised per round drop significantly. This chart by Carta helps put numbers to the drop in fundraising. based on our market observations, at Thunder, we believe that this year will likely be a stagnant year (compared to 2023) with less volatile drops, but also no return to easy venture money.

-------------------------------------------------------------------------------------------------------------------------------------------------------------Fundraising Demystified Episode #29 is Live!

.png?width=600&height=338&name=Fundraising%20Demystified%20%20Youtube%20Thumbnail%20(8).png)

Get ready for an episode that's a game-changer for SaaS enthusiasts! Kaustav Das, the visionary CEO and co-founder of Efficient Capital Labs, dishes out the details on revenue-based financing and its magic touch in turbocharging SaaS companies. Here's what's in store: The ins and outs of revenue-based financing and how it pumps cash into companies upfront based on their future earnings. The strategy of widening your capital-raising horizons, avoiding the usual dependence on just a handful of top-notch venture capitalists. Giving your business a makeover by standing out in global markets and building a strong risk assessment system.

Be inspired by his insights into revenue-based financing, where banking data, accounting details, contracts, and VC funding play critical roles. Kaustav's got your back, highlighting the nuances and fees tied to debt facilities and unraveling the mysteries behind effective interest rates. It's like a finance makeover for your business – and Kaustav's the cool guide leading the way!

Meet Kaustav Das, the mastermind with 21 years in risk management, which propelled ECL to secure $10.5 million in equity and a $100 million debt facility. His goal is to revolutionize global finance, removing geographical barriers to capital costs and offering speedy, efficient, and affordable solutions, particularly transforming the business finance scene in emerging markets such as South Asia.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

🤓 - Free pitch deck reviews - Submit your deck

💸 - Access working capital fast - Explore options for free

😍 - Free list of AI Recommended VCs - Apply for free

👨💻 - Free fundraising coaching session - Schedule 15 minutes with us

Premium Resources

Your pitch deck built by VCs and designers

🗓️ - Book a one-hour private capital strategy call - Book Now

💫 - Pitch deck design services for founders by VCs - Decko

💼 - Startup Legal Services - Bowery Legal

📚 - Startup Friendly Accounting Services - Chelsea Capital

Upgrade to Thunder Premium to Unlock:

- Access to VC firms' team tabs to see active partners of the fund & their LinkedIn

-

Navigate a VC's portfolio to see relevant portcos or competitors, quickly find their founders on LinkedIn to connect with them, and request warm introsA downloadable CSV with the investor emails & LinkedIn URLs

- Ability to filter your matches and adjust your profile

-

LiteCRM to track your progress

-

Request intros to VCs directly through the platform

- Get our fundraising guide on how to increase your odds of getting a meeting

- Upgrade to lifetime access (one-time fee of $497) and get a free coaching session

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc