Hey,

Today I help you decode what investors are really saying when they respond to you.

Also;

📸 - Social Snapshot- VC investing's dark secrets

📊 - The cost of SAFEs

🎙️ - The Whisper Way w/ Carrie Kerpen

🆓 - Your guide to the first call with an investor

Welcome to issue 105.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Your Pitch Deck Probably Sucks...

For most first-time founders, the idea of a pitch deck sounds easy, but I often get decks with "v43" in the filename, implying it's the 43rd iteration of a deck 😖

Don't be this founder. Collaborate with active VCs on your deck and pay a professional designer to eliminate the guesswork and make a strong first impression when you're ready to pitch investors.

I use DECKO for my clients to ensure I'm getting the expertise we need to get a great deck turned around quickly. They're a group of active VCs who help founders with their decks, you can't go wrong. And you get 10% off with the link below.

Give them a try.

Upgrade Your Pitch Deck with Decko

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Social Snapshot

💰 The dark secrets of VC investing by Rahul Mathur on X

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Scaling and Selling to Eight-Figure Exits with Carrie Kerpen - EP 69

I speak to Carrie Kerpen, founder of The Whisper Group and author of the upcoming book "The Whisper Way". Learn more about her experience founding one of the earliest social media agencies to crafting an intentional path to a major eight-figure exit, to her efforts supporting female founders.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Data Corner

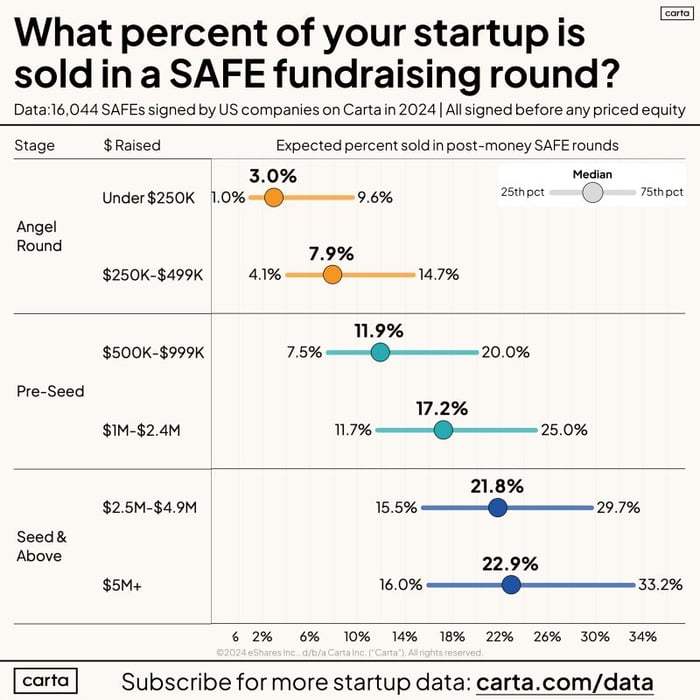

The cost of SAFEs

Founders, SAFEs might be fast and easy, but they’re not free money—you’re still trading equity for cash.

Here’s the breakdown from 16,000+ SAFEs signed in 2024:

- Angel Rounds: <$250K = ~3% dilution, $250K-$499K = ~8%

- Pre-Seed: $500K-$999K = ~12%, $1M-$2.4M = ~17%

- Seed and Above: $2.5M-$4.9M = ~22%, $5M+ = ~23%

Key takeaways from Carta:

- SAFE dilution varies a lot—your background as a founder can make or break your terms.

- SAFEs are still mostly founder bets; repeat founders usually snag better caps.

- Stacking SAFEs might feel clever, but remember: post-money SAFEs = stealth anti-dilution for investors.

Bottom line: SAFEs can work, but don’t be afraid of priced rounds!

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Raising Capital for your startup?

Thunder's mission is to guide founders toward the right path to reach their North Star, be it through securing equity or debt financing or navigating the path to a successful exit.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Handling Frustrating Investor Questions (and Responses)

I've worn both hats; founder and investor. I definitely had to learn how to understand what investors were really saying when I was pitching them, and as an investor, I take a no-BS approach when talking to founders so they know exactly what I am saying.

Pitching to investors can feel like a game of mental gymnastics. You’re not just selling your business—you’re navigating loaded questions, vague rejections, and downright annoying comments. But here’s the thing: how you handle these moments can make or break your round. I've already talked about questions you should ask VCs so here are some of the most frustrating questions they can ask you, plus responses—and how to work them for a check.

1. "Why isn't your growth faster?"

Translation: “Impress me with an answer that makes me forget this is a risky bet.”

Your Move: Highlight how you’re focused on sustainable growth over vanity metrics. Share tangible proof, like how customer retention has climbed significantly in recent months, demonstrating that you’re building a foundation for long-term success.

2. "What if [Big Competitor] does the same thing?"

Translation: “Convince me you’re not about to get crushed.”

Your Move: Show how you’ve carved out a niche that gives you agility competitors can’t match. Explain how your solution targets a specific market need and why customers choose you over the big players.

3. "How do you know your valuation is justified?"

Translation: “I think you’re bluffing.”

Your Move: Justify your valuation with data. Break down how your ARR, CAC, and other metrics stack up against similar companies, and present it confidently but transparently.

4. "Why are you raising money now?"

Translation: “Is this a panic raise?”

Your Move: Reframe the timing as a strategic decision. Outline how the capital will help you hit key milestones and set the stage for future scalability. Mention any recent validations that show now is the perfect moment to scale.

5. "What happens if you can’t raise more capital?"

Translation: “Are you doomed without us?”

Your Move: Emphasize your resilience by explaining your path toward profitability. Share your contingency plan and demonstrate that you’re not overly reliant on external funding to achieve your goals.

6. "Why should I believe in you over other founders?"

Translation: “Make me feel like this is a sure bet.”

Your Move: Lean into your track record and vision. Highlight your experience, previous successes, and how your team’s unique expertise positions you to execute the vision better than anyone else.

7. "What’s stopping your team from leaving or burning out?"

Translation: “Convince me your team won’t collapse.”

Your Move: Showcase the strength of your team culture and the incentives in place. Talk about equity alignment, retention rates, and how you’ve created an environment where people thrive and stay invested for the long haul.

8. "What’s your exit strategy?"

Translation: “How do I get paid?”

Your Move: Present a flexible but compelling vision. Discuss opportunities for strategic acquisitions while emphasizing your focus on building long-term value and capturing a significant portion of your total addressable market.

9. "Let us know when you have more traction."

Translation: “You’re too early, but I don’t want to say no outright.”

Your Move: Pin them down on specifics. Ask what metrics or milestones they would need to see to make you a fit for their portfolio, turning vague interest into actionable feedback.

10. "This sounds interesting, but it’s not a fit for us right now."

Translation: “I’m not interested, but I don’t want to burn bridges.”

Your Move: Politely dig deeper to understand their reasoning. Ask why it’s not a fit and whether they’d reconsider at a later stage, or if they can point you toward other investors who might align better.

11. "We like it, but we need a lead investor first."

Translation: “We’re not ready to take the plunge alone.”

Your Move: Leverage this as an opportunity to create urgency. Share that you’re in advanced conversations with other potential leads and keep them updated on your progress to build momentum.

12. "I’ve seen a lot of companies like this—it’s a crowded space."

Translation: “Differentiate or die.”

Your Move: Double down on what makes you unique. Highlight metrics that showcase why customers prefer your product, such as lower churn rates or superior satisfaction scores.

13. "We need to wait and see what the market does."

Translation: “I’m hesitant to commit right now.”

Your Move: Shift the focus to your ability to capitalize on current trends. Explain how you’re mitigating risks and positioning yourself as a leader regardless of market fluctuations.

14. "You’re a bit early for us, but keep us in mind later."

Translation: “Good luck… we’re out.”

Your Move: Turn rejection into opportunity. Ask if they can introduce you to investors who focus on earlier-stage companies or provide feedback to strengthen your pitch for future conversations.

15. "Your ask is too high for this stage."

Translation: “Your valuation feels inflated.”

Your Move: Defend your position by walking them through benchmarks. Compare your metrics to similar companies and explain why your valuation aligns with industry standards, reinforcing your confidence in the ask.

Every founder faces these questions and responses at some point, but how you handle them can set you apart. Remember, investors are human—skeptical humans looking for reasons to say no. Your job is to eliminate those reasons by staying calm, confident, and prepared.

So, the next time an investor throws you a curveball, don’t flinch. Use it as an opportunity to showcase why you’re the founder who’s worth betting on.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Happy with Fundraising Demystified?

Let me know how you like the newsletter (it will only take a minute). Any topics you'd like me to cover? Click below and share.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

As you set goals for the new year, here's my guide to planning out your fundraising over 12 months:

🗓️ Your 12-month fundraising plan- Download it here

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc