Hi,

Today I talk about the importance of keeping everything documented- both internally and for investor-readiness reasons. Also,

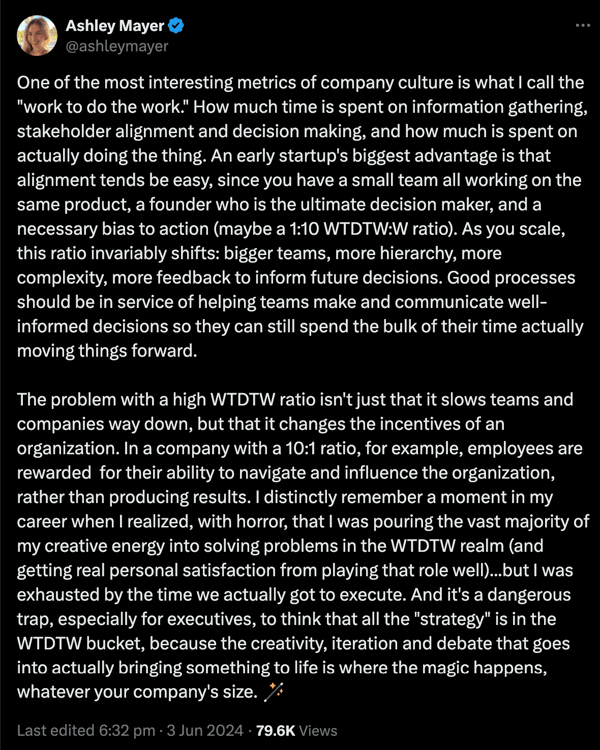

📸 - Social Snapshot- Insights on "work to do the work"- a company metric on info gathering.

📊 - Private debt on the rise

🎙️ - Fundraising Demystified Season 2 Top 5

🆓 - Startup resource- Term Sheet Negotiation Playbook

Welcome to issue #88 and may your cap tables be clean and your investors plentiful!

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Your Pitch Deck Probably Sucks...

For most first-time founders, the idea of a pitch deck sounds easy, but I often get decks with "v43" in the filename, implying it's the 43rd iteration of a deck 😖

Don't be this founder. Collaborate with active VCs on your deck and pay a professional designer to eliminate the guesswork and make a strong first impression when you're ready to pitch investors.

I use DECKO for my clients to ensure I'm getting the expertise we need to get a great deck turned around quickly. They're a group of active VCs who help founders with their decks, you can't go wrong. And you get 10% off with the link below.

Give them a try.

Upgrade Your Pitch Deck with Decko

-------------------------------------------------------------------------------------------------------------------------------------------------------------Social Snapchat

On the topic of documentation, Ashley Mayer shares a take on X "work to do the work".

Also:

🔮 Factors that predict seed-stage startup outcomes- Adam Shuaib shares the top factors vetted by Ai on LinkedIn

🦄 How long does it take to reach unicorn status? Ilya Strebulaev on X

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Season 2 Top 5 episodes: Fundraising Demystified

The podcast is still on summer break but we put together a list of the most popular episodes for you to check out.

Listen to real stories from founders and investors on their journey to raising capital on your favorite platform.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Data Corner

Private Debt Still On The Rise

In 2023, global private debt funds achieved a rolling one-year IRR of 9.2%, ranking them as the second-best performing strategy, just behind private equity, which posted a 10.5% return last year, according to PitchBook’s Q4 2023 Global Fund Performance Report.

Mezzanine funds were the top performers. In case you don't know what those are, mezzanine funds provide subordinated debt with equity-like features, often used in leveraged buyouts. It bridges the gap between senior debt and equity, offering higher returns with increased risk.

PS: At Thunder, we support founders raising working capital by connecting them to financing options in minutes, rather than months. Access it in the free founder resource section below.

----------------------------------------------------------------------------------------------------------------------------------------------------------

Trust No One, Document Everything

I want to talk about something we all love to hate—documentation. Yes, I know, it’s about as exciting as watching paint dry, but stick with me. Whether you’re just getting started with your startup or knee-deep in fundraising, proper documentation can be your secret weapon. Think of it as the spinach in your startup’s smoothie—might not taste great, but it’s packed with the nutrients you need to thrive.

The Magic of Internal Documentation

First off, let’s chat about internal documentation. I get it—when you’re moving a million miles a minute, the last thing you want to do is stop and write things down. But here’s the deal: well-documented processes save you time in the long run. Plus, if you ever want to scale or bring new folks on board without losing it, having a clear playbook is key.

-

Create a Living Doc: Treat your documentation like it’s alive—because it is! Your startup isn’t static, so your processes shouldn’t be either. Use tools like Notion or ClickUp to keep everything in one place, and make sure it’s accessible to the whole team. Remember, no one has time to play Sherlock Holmes when trying to find that one important file.

-

The 80/20 Rule: Focus on documenting the 20% of processes that cover 80% of your activities. You don’t need a novella for every little thing—just the key tasks that keep the wheels turning.

-

Version Control is Your Friend: There’s nothing worse than multiple people editing a doc and then wondering who broke what. Use version control to keep track of changes, and always have a way to revert back if someone goes rogue (accidentally, of course).

The Investor Angle—Track It or Lose It

Now, let’s flip the script to fundraising. We all know talking to investors can be like herding cats. One minute, they’re all in; the next, they’re ghosting you. That’s why keeping track of your conversations is crucial.

I was keen to write about this after listening to some founders talk about how they thought. they had made agreements with investors (verbally), only to learn to their peril that it doesn't count unless it's in writing. Here’s how to stay on top of your game:

- Investor CRM: Think of an Investor CRM (Customer Relationship Management tool) as your memory on steroids. Keep track of every conversation, every follow-up, and every promise made. Tools like HubSpot or Affinity can help, but even a well-organized Google Sheet can work wonders. The key is to know where you stand with each investor at any given moment.

- The Art of the Follow-Up: Investors are busy people. A well-timed follow-up can be the difference between a successful raise and radio silence. Document your touchpoints and set reminders to ping them with updates. It’s all about staying top of mind without being a pest.

- Capture the Insights: Investors will drop nuggets of gold during your chats—whether it’s feedback on your pitch, interest in a particular feature, or just general advice. Capture these insights immediately. It’ll help you refine your pitch and show investors you’re actually listening (which they love, by the way).

Keep It Simple

Documentation doesn’t have to be a chore. Keep it simple, keep it relevant, and most importantly, keep it up to date. Your future self (and your team) will thank you. Plus, when it comes time to raise that next round, you’ll be the founder with all your ducks in a row while everyone else is scrambling to find that one email; investor readiness starts here.

So, embrace documentation when necessary. Your startup (and sanity) will be better for it.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Happy with Fundraising Demystified?

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

This week, we share our playbook for setting up your data room to make you investor-ready.

📖 - Playbook for Setting Up and Sharing Your Data Room - Download it Here

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc