What's Below in Issue #66:

📰 - A look into if you need a cofounder

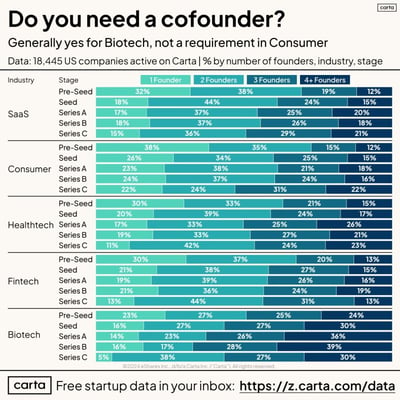

📊 - Data behind how many startups have cofounders by stage

🎙️- Podcast w/ Ali Ansari

💵- Premium startup resources

🆓- Free startup resources

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Have revenue and need access to quick capital?

The cost of equity capital is getting expensive; debt or working capital might be a better option if you're already generating revenue, and it's non-dilutive.

We've made it easier than ever to get matched with private capital providers and receive offers in minutes, not weeks or months.

*We don't charge any fees to source you debt*

Explore Non-dilutive Financing

------------------------------------------------------------------------------------------------------------------------------------------------------------

Do I Need a Co-Founder?

My favorite circus act has always been juggling. There is a hypnotic feeling that comes with watching the pins circle in impossible patterns. As an adult, it reminds me of how difficult it is to balance too many tasks. There are always people who can juggle 15 balls, but for most people, even juggling 3 is difficult.

Running a company is difficult. There is building a product, finding customers, raising money, hiring a team, marketing, and more. It’s a lot of work for one person to handle. That’s why many founders look for a co-founder to join them on their journey. It lets you switch from juggling one 15 balls to just 5. Still hard - but not nearly as difficult.

On the other hand, by sharing the tasks with someone else, you lose control of how you want to juggle all of them. Half the act is done and controlled by someone else. It is not an easy choice to make, but one that we will hopefully help you navigate in this article.

Teams with more than one founder

outperformed solo founders by 163%.

Just The Numbers

Before we discuss the advantages and disadvantages of having a cofounder, let’s look at the numbers.

Solo founders are much less likely to succeed at building their company. According to First Round Capital, teams with more than one founder outperformed solo founders by 163%. Additionally, solo founders' seed valuations were 25% less than teams with more than one founder. This is especially true for Enterprise startups where they perform 230% better if there is a technical cofounder specifically.

To make it more dramatic, 80% of all billion-dollar companies launched since 2005 have had two or more founders.

With those types of numbers, it seems reasonable to want a cofounder - and most do. According to Carta, less than 20% of startups have only one founder after their Series A. Having someone to split the challenges helps with quick scaling.

Not Every Founder Needs a Cofounder

While the numbers might convince any founder that they need a cofounder ASAP, it is important to look at how many companies have been successful with a single founder. Just look at Amazon, Dell, eBay, and Tumblr. They are all founded by a single person. While we mentioned before, 80% of all billion-dollar companies launched since 2005 have had two or more founders, it is also true that 20% of those companies succeeded with just a single founder.

According to a Harvard Business Review study, not every founder needs a cofounder to be successful, but they do need a “co-creator” to be successful. This can be employees, alliances, and mentors to help them build their businesses. The advantage of this structure is that you can benefit from the same ideation, support, and network without sacrificing much equity or creating challenges around control.

Advantages of a Cofounder

Having a partner in crime to run your startup can help in the following ways:

- You have more skills and expertise: No one is good at everything. You may have a brilliant idea but lack the technical, business, or marketing skills to execute it. A co-founder can fill in the gaps and bring a different set of skills and expertise to the table. Together, you can cover more ground and create a better product or service.

- You have more support and motivation: Starting a company can be lonely, stressful, and risky. You may face many challenges, setbacks, and doubts along the way. A co-founder can provide you with emotional, moral, and financial support. You can also motivate and inspire each other, and celebrate your wins together.

- You have more perspectives and feedback: Having a co-founder means having another pair of eyes and ears on your project. You can brainstorm, discuss, and debate ideas with your co-founder, and get honest and constructive feedback. A co-founder can also challenge you and push you to think outside the box and improve your product or service.

- You have more credibility and network: Having a co-founder can boost your credibility and reputation in the eyes of potential customers, investors, and partners. It shows that you have a strong team and a serious commitment to your venture. A co-founder can also expand your network and help you access more resources, opportunities, and connections.

The Challenges of Having a Co-Founder

Having a co-founder is not all roses and rainbows. There are also some drawbacks and difficulties that come with having a partner. Here are some of the challenges of having a co-founder:

- You have less control and autonomy: When you have a co-founder, you have to share the decision-making and the ownership of your company. You can’t just do whatever you want, whenever you want. You have to compromise, negotiate, and align with your co-founder on every aspect of your business. You may also have to deal with disagreements, conflicts, and power struggles. There will be times when you will do things in a different way than you had initially imagined.

- You have less equity and flexibility: With more people at the party, you need to split the cake more ways. The equity of your company will need to be split between you. This means that you get to keep less of the rewards of your hard work. You also have to consider the vesting and dilution of your equity, which can complicate your relationship with your co-founder. Additionally, you have less flexibility to change your direction, strategy, or product, as you have to consult and convince your co-founder first.

- You have more risk and responsibility: When you have a co-founder, you have to trust and rely on them. You have to make sure that they are competent, committed, and compatible with you. You also have to be accountable and responsible for their actions and performance. If your co-founder leaves, fails or betrays you, it can have a devastating impact on your company and your morale.

How to Find a Co-Founder

If you decide that you need a co-founder, the next question is how to find one. Finding a co-founder is not easy. It requires a lot of networking, research, and trust. You want someone who shares your vision, passion, and values, but also brings a different perspective and skill set to the table. It will be like searching for a needle in a haystack. Here are some tips on how to find a potential co-founder:

- Your network: The most obvious place to start is your own network of friends, family, colleagues, classmates, mentors, etc. You may already know someone who is interested in your idea or has a complementary background. You can also ask for referrals from people you trust and respect.

- Events and communities: Another way to find a co-founder is to attend events and join communities related to your industry, niche, or interest. You can meet like-minded people who are also looking for co-founders or collaborators. You can also pitch your idea and get feedback from others. Some examples of events and communities are hackathons, meetups, accelerators, incubators, online forums, etc.

- Platforms and services: Some various platforms and services help connect founders with co-founders. You can create a profile, browse through potential matches, and reach out to them. Some examples of platforms and services are CoFoundersLab, Founder2be, FoundersNation, etc.

If you’ve found someone you feel will be a good fit to be your partner in crime, it is time to have a trial period. Taking time to work together on different projects will help you see how you work together as a team. Try building something together over the course of a few weeks that requires a high level of collaboration and ideation. You want to see how you work through arguments and difficult decisions.

Splitting Equity

It may seem unfair to give someone else 50% of your company when you thought of the idea. However, you want them to be an equal partner and put in their full effort. How much should you be giving?

There are several approaches founders can take. Here are a few:

- Equal splits: While this may seem the fairest since you are equal partners, it creates many problems. First, it assumes that the founders are contributing equally. Second, it creates governance problems since the founders have equal votes and can sink the company if they have a deadlock on an issue. The second problem can be solved by splitting 51-49 so that one founder has the final say on issues.

- Weighted contributions: The equity is split based on the amount of time or projects done by each founder. This works well when one founder can only work on the startup part-time, or has other restrictions that keep them from putting in an equal amount as the other founder. Additionally, if one founder set up most of the startup and the second joined later, it is reasonable to give more equity to the first founder.

- Role-based splits: Most assume that the CEO is more impactful than the CTO or COO, and therefore should carry a larger part of the equity.

Once you have decided on an equity split, founders should think about vesting schedules to ensure neither will leave while building the company.

Relevant Articles for Finding a Co-Founder

- How to split equity among co-founders in a startup: 11 factors to consider- 👉 Stripe

- How to find a co-founder for your startup - 👉 Carta

- Startup Founders and Co-Founders — Everything You Need to Know - 👉 Startups.com

-------------------------------------------------------------------------------------------------------------------------------------------------------------Data Corner

Cofounders by the numbers

Being a single founder is quite common during the pre-seed stage but decreases as the stages increase. The data can suggest two conclusions: (1) single founders shut down more often between the pre-seed and seed stage than founding teams, and (2) the second founder is often added after the seed stage when the company starts growing quickly. It is also important to note that certain sectors are more prone to single founders (SaaS and Consumer), while others are not (Biotech).

-------------------------------------------------------------------------------------------------------------------------------------------------------------Fundraising Demystified Episode #34 is Live!

.png?width=600&height=338&name=EP%2034%20Alon%20Talmor%20YT%20Thumbnail%20(revised).png)

In this episode, Alon Talmor, the co-founder of Ask-AI, walks us through his journey of raising capital during the Financial Crises for his first company and selling it to Salesforce, then finding himself in another tough market raising $20M for his current company, Ask-AI.

Alon shares his insights into the future of AI and where the market is today as every company is trying to adapt. He also discusses how he built deep relationships with just a few investors and the challenges he faced raising capital in a down market in a crowded sector.

Beginning with the success story of BlueTails, a startup he founded and later sold to Salesforce, Alon walks us through the transition from startup to corporate life. He also talks about how he started Ask-AI and the importance of validation and building relationships with design partners. He shares insights into the fundraising process, including the challenges of raising capital and the importance of honesty and trust with investors.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

🤓 - Free pitch deck reviews - Submit your deck

💸 - Access working capital fast - Explore options for free

😍 - Free list of AI Recommended VCs - Apply for free

👨💻 - Free fundraising coaching session - Schedule 15 minutes with us

📝 - Playbook for Negotiating Term Sheets - Download it Here

💽 - Playbook for Setting Up and Sharing Your Data Room - Download it Here

✉️ - Playbook for Sending Investing Updates - Download it Here

Premium Resources

Your pitch deck built by VCs and designers

🗓️ - Book a one-hour private capital strategy call - Book Now

💫 - Pitch deck design services for founders by VCs - Decko

💼 - Startup Legal Services - Bowery Legal

📚 - Startup Friendly Accounting Services - Chelsea Capital

Download Your List of Targeted Investors:

- Access to VC firms' team tabs to see active partners of the fund & their LinkedIn

-

Navigate a VC's portfolio to see relevant portcos or competitors, quickly find their founders on LinkedIn to connect with them, and request warm introsA downloadable CSV with the investor emails & LinkedIn URLs

- Ability to filter your matches and adjust your profile

-

LiteCRM to track your progress

-

Request intros to VCs directly through the platform

- Get our fundraising guide on how to increase your odds of getting a meeting

- Upgrade to lifetime access (one-time fee of $497) and get a free coaching session

Upgrade Now for $59/month

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc