Hi,

The funding winter is upon us- I share some thoughts on how to get through the cold.

Also;

📸 - Social Snapshot- PMF

📊 - VC Season

🎙️ - Episode 63: Donor-advised funds with Patrice King-Brickman

🆓 - Your 12-month fundraising plan

Welcome to issue #99!

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Want a Fundraising Audit?

Not sure why investors are passing? Want to know the answer? Are you based in the US, Canada, or the UK?

Book a discovery call with us we will give you the answer you're looking for and help you get on the right path for your business.

Full disclosure, it might take more than a 20min call to give you an exact answer, but we have to start somewhere.

-------------------------------------------------------------------------------------------------------------------------------------------------------------Social Snapchat

💡A take on PMF by Kevin Jurovich on X.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Episode 63: Using Donor-Advised Funds to Power Underrepresented Startups with Patrice King Brickman

.png?width=600&height=600&name=EP%2063%20-%20Episode%20Art%20(1).png)

I speak to Patrice King-Brickman about donor-advised funds. I explore raising venture capital from nonprofit organizations through donor-advised funds (DAFs). These funds, collectively holding over $200 billion, are traditionally invested in low-yield assets like index funds and real estate.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Data Corner

VC Season

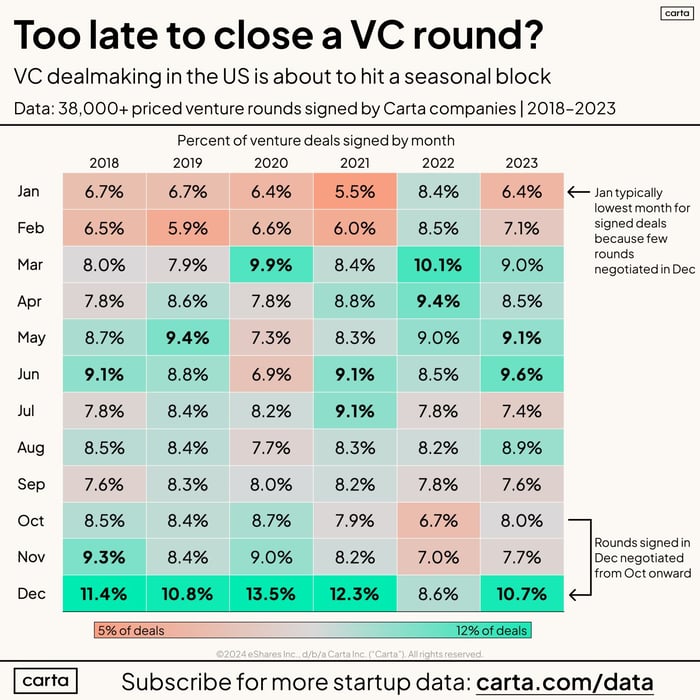

Founders, heads up—venture deal-making is about to hit the holiday slowdown. While December sees the most deal signatures, those talks usually started months ago. Kicking off a full fundraising process post-Thanksgiving? Tough timing. That’s why January’s usually the quietest for deals, with February not far behind. New year negotiations, though, often wrap up by March.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Raising Capital for your startup?

Thunder's mission is to guide founders toward the right path to reach their North Star, be it through securing equity or debt financing or navigating the path to a successful exit.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Surviving the Funding Winter: How to Raise Capital When Investors Are Tightening Belts

Picture this: it’s a chilly funding winter, and investors are hibernating with their wallets tightly zipped. You’re a founder, armed with an amazing product, big dreams, and a pitch deck you’ve poured your soul into. Yet, every VC meeting ends with “We love what you’re doing, but it’s not the right time for us.” Sound familiar? You’re not alone.

When markets get shaky, so does the flow of capital. Investors are more cautious, scrutinizing every deal with a microscope. But here’s the thing: great companies get funded even in the toughest markets. The question is, how do you make it happen? Let’s dive into the survival kit for raising capital when money is tight.

1. Prove You’re Recession-Proof

Investors are skittish about risky bets in uncertain times. To stand out, show them your startup isn’t just surviving the downturn—it’s thriving. How? Highlight stable or growing revenues, strong unit economics, and a clear path to profitability. If you’re pre-revenue, emphasize cost control and a scalable business model.

Take Zoom during the pandemic—a shining example of being in the right place at the right time with the right product. You might not have a pandemic-tailored solution, but you can frame your startup as essential in any economic climate.

2. Focus on Warm Intros

In funding winters, cold emails get frostier responses. This is the time to leverage your network like never before. Find connections who can vouch for you and make warm introductions to investors. People invest in people they trust, and trust is built through referrals.

If your network feels thin, join founder communities, attend startup events, or even reconnect with old colleagues. You’d be surprised how many people are willing to help—if you ask the right way.

3. Cut the Fluff in Your Pitch

When money’s tight, investors have no patience for grandiose visions without clear execution plans. Your pitch needs to be lean, direct, and compelling. Answer these questions upfront:

-

Why is this the perfect time for your startup to succeed?

-

What’s the ROI for investors?

-

How will you use their capital to achieve specific milestones?

Skip the fluff and focus on tangible outcomes. Remember, clarity breeds confidence.

4. Get Creative With Financing

If traditional venture capital feels like pulling teeth, consider alternative routes. Revenue-based financing, venture debt, or strategic partnerships can keep the lights on without giving away equity. Grants and startup competitions also offer a lifeline—free money with zero dilution.

Shopify, for instance, got creative in its early days by securing government grants before it ever raised VC. A little creativity can go a long way when cash is scarce.

5. Extend Your Runway

This one’s less about raising capital and more about making the most of what you’ve got. Investors love to see founders who are resourceful with capital. Review your expenses, trim the fat, and find ways to do more with less. Extending your runway shows you’re not just relying on external funding to stay afloat.

The Takeaway

Yes, fundraising in a downturn is tough, but it’s not impossible. Tighten your pitch, get creative with funding, and prove you’re worth the bet. Remember, great companies like Airbnb and Slack were built during economic downturns. If they can do it, so can you.

The funding winter might be cold, but it’s also the perfect season for founders who refuse to quit. Bundle up, get scrappy, and go make it happen!

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Happy with Fundraising Demystified?

Let me know how you like the newsletter (it will only take a minute). Any topics you'd like me to cover? Click below and share.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

A brand new one! Fundraising does not begin when you need capital. I break down what you need to do to raise funds before you even speak to an investor.

📞 The 12-month fundraising plan- Download it here

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc