What's Below in Issue #62:

📰 - A look into how to calculate your market size

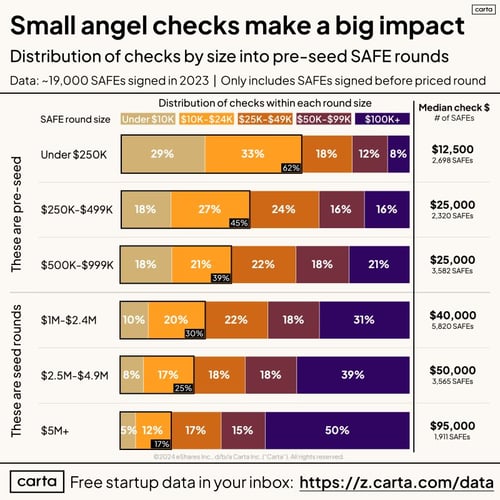

📊 - Data behind the importance of small angel checks

🎙️ - Podcast w/ Frank Licea

💵- Premium startup resources

🆓- Free startup resources

-------------------------------------------------------------------------------------------------------------------------------------------------------------

![]()

New Government Law Could Cost You $500/Day!?

Congress passed the Corporate Transparency Act (CTA), and now qualifying businesses must submit a Beneficial Ownership Information Report or be subject to government fines up to $10,000 or $500/day with potential jail time.

It's a harsh punishment, but we've partnered with BOI Zen to make it easy to get compliant and stay compliant to avoid the government from taking your fresh capital.

You'll never have to worry about getting fined with our friends at BOI Zen

------------------------------------------------------------------------------------------------------------------------------------------------------------TAM/SAM/SOM? - You're Probably Doing It Wrong. Let's Talk About Properly Calculating Your Market Size

How big is your market? What are you telling VCs?

Are you sure it’s that big? I'm willing to call your bluff. Most founders use the wrong numbers when describing their market size.

We will take the example of a startup that sells AI baby diapers.

A quick Google search will tell us that the global baby product market is $320 Billion. Is that the right market size? Definitely not. This number includes cribs, clothing, toys, and services. None of those subsectors will be replaced by the AI diaper. Additionally, entire markets will almost certainly be unable to afford the AI diaper.

Another Google search will tell us that the US baby diaper market is $11.3B. Is that the right market size? Maybe, but probably not. This number includes ALL diapers, but not everyone wants or can pay for an AI diaper. The AI diaper is much more expensive than a traditional diaper and, therefore, will only appeal to upper-class families.

To begin, let’s define our market sizes. The three main metrics used are:

- Total Addressable Market (TAM): This is the total number of potential customers who could use your product or service, regardless of any constraints or barriers. For the AI diaper startup, this would be the total number of babies in the world who need diapers.

- Serviceable Addressable Market (SAM): This is the subset of TAM that is within your reach, such as geographic, regulatory, or technological boundaries. For the AI diaper startup, this would be the total number of babies in the United States since that is where shipping is currently easy and possible.

- Serviceable Obtainable Market (SOM): This is the subset of SAM that you can realistically capture, considering your competitors, pricing, distribution, and other factors. For the AI diaper startup, this would be the total number of babies whose parents are willing and able to pay for the AI diaper and prefer it over other alternatives – mainly upper-class families.

There are also two different ways to calculate these metrics:

- Top-down looks at the size of an entire market and how much money is being spent. For us that would be the total number being spent on diapers in a specific market. This number is usually easier to find online since most strategy and consulting firms calculate it.

- Bottom-up is very company-specific. It looks at the volume that is or can be sold and how much you could earn with your product.

Most VCs prefer the bottom-up approach since it gives a much better view of who your customer base is, how much you can earn, and what you will need to do to expand your market.

Now, let’s work this example through in terms of how to calculate (FYI numbers used are mostly fictional).

TAM

According to the World Bank, the total population of babies (0-4 years old) in the world was 681 million in 2020. Assuming that each baby uses 6 diapers per day on average, the total number of diapers needed per day in the world is 4.1 billion. Assuming that you can sell your diaper for $1, the total revenue potential of the diaper market in the world is $4.1 Billion per day or $1.5 Trillion per year. Lots of diapers and lots of money.

Again, this is including many people who could never afford to buy your diaper. But the size of the market is large enough to

SAM

In 2022 there were 22 million children in the US between 0 – 4 years old. Using the same method as above, the total number of diapers needed per day is 132 million. Assuming that the average price of a diaper is $1, the total revenue potential of the diaper market in these countries is $132 million per day, or $48 Billion per year. Still a lot of diapers. And still a lot of money.

SOM

We assume that only higher-income earners will be able to afford a more expensive diaper. According to the Pew Research Center, 19% of US households had an annual income of more than $100,000 in 2019. This means that 4.18 million babies are part of families that can afford AI diapers or 25 million diapers per day. With a cost of $1 per diaper, this leads to a potential earnings of $25 Million per day, or $9.12 Billion per year.

While this number is still very large and there are other factors to consider, it demonstrates the available behemoth market.

As you can see, the market sizes vary significantly depending on the assumptions and calculations you make. It is important to be realistic and transparent about your numbers and sources and to explain your logic and reasoning to your potential investors. You should also update your market sizes as you get more data and feedback from your customers and competitors. Remember, your market size is not a fixed number, but a dynamic and evolving estimate that reflects your vision and strategy.

Market Growth

In addition to the classic TAM, SAM, and SOM, it is valuable to show market growth. Using a top-down approach for this section is usually acceptable since it is quite difficult to calculate for your specific product type. Investors are looking for fast-growing markets since those are the ones where new potential revenue and opportunities are always available.

Some ways you can find growth metrics:

- Use data from industry reports, market research firms, or government agencies to find the historical and projected growth rates. For example, you can use data from Statista, IBISWorld, or the US Bureau of Labor Statistics to find the annual growth rate of the baby product market.

- Use data from your competitors, customers, or partners to estimate the growth rate. For example, you can use data from your competitors’ websites, press releases, or financial statements to find out their revenue growth and market share. You can also use data from your customer surveys, interviews, or feedback to find out their demand and satisfaction for your product. You can also use data from your partners’ contracts, agreements, or referrals to find out their support and collaboration for your product.

- Use your data and assumptions to forecast the growth rate of your product. For example, you can use data from your product development, testing, or launch to find out your product quality, performance, and innovation. You can also use your assumptions about your pricing, marketing, distribution, and customer acquisition strategies to find out your product profitability, awareness, and retention.

Expanding Your Markets

Finally, once you’ve shown how big your market is, and how fast it is growing, it is time to show where else you can expand to.

Every large company has expanded to industries they never expected to when they were small. However, this natural growth shows how much larger your startup can be if you succeed.

For example, with AI diapers, a natural market to expand to would be adult diapers. Demonstrating that this market is a natural expansion from a successful baby diaper technology emphasizes how much larger your market can be.

Relevant Articles for Calculating Market Size

- How To Effectively Determine Your Market Size- 👉 Forbes

- Market Sizing Guide - 👉 Pear VC

- Startup market size: why it matters, what is it, and how to estimate it - 👉 Latitud Ventures

-------------------------------------------------------------------------------------------------------------------------------------------------------------Data Corner

Embrace the Small Checks

It may seem annoying to collect many small checks when a few large ones would fill your need easily. However, small checks (less than $25K) made up 62% of the money raised for very early-stage rounds (less than $250K). Even larger rounders that raised $1M had close to 40% of their money from small checks.

These investors are often your biggest champions. Embracing them can be key to raising a successful round.

-------------------------------------------------------------------------------------------------------------------------------------------------------------Fundraising Demystified Episode #30 is Live!

In this episode, Frank Licea talks about his employee-to-entrepreneur journey and the unexpected fundraising success of Howdy.com as a service-oriented company that raised $18 million in funding. He also shares his perspective as a Chief Technical officer and how bootstrapping has helped them create an upper hand during fundraising pitches and negotiations.

Here are the key takeaways:

How Howdy started:

- Frank faced talent shortages while working as an engineering leader in Austin due to high competition and rising salaries.

- He saw existing solutions like freelancer platforms and big outsourcing firms weren't ideal for building long-term, quality teams.

- Howdy was born to provide a platform where US companies could hire, manage, and retain Latin-American software developers as if they were local employees.

Bootstrapping vs. Y Combinator:

- Howdy began bootstrapping as they didn't see initial investor interest in their service-oriented business model.

- They achieved profitability early on, making their growth self-sustainable.

- Joining Y Combinator provided access to mentors, investors, and the potential for faster scaling.

Masterclass in Finding a Technical Co-founder:

- Frank shared his experience finding Jacqueline, his co-founder and CEO.

- Shared values and alignment on long-term goals were crucial for building a strong partnership.

- Offering equity splits that reflect the contributions and risks each co-founder takes is essential.

Fundraising Experience:

- Howdy raised $3 million in seed funding after Y Combinator

- They waited until near demo day to maximize leverage and attract bigger checks.

- They used a video instead of a standard pitch deck to stand out and communicate their story effectively.

- They ended up raising a total of $18M from YC and Greycroft.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

🤓 - Free pitch deck reviews - Submit your deck

💸 - Access working capital fast - Explore options for free

😍 - Free list of AI Recommended VCs - Apply for free

👨💻 - Free fundraising coaching session - Schedule 15 minutes with us

Premium Resources

Your pitch deck built by VCs and designers

🗓️ - Book a one-hour private capital strategy call - Book Now

💫 - Pitch deck design services for founders by VCs - Decko

💼 - Startup Legal Services - Bowery Legal

📚 - Startup Friendly Accounting Services - Chelsea Capital

Upgrade to Thunder Premium to Unlock:

- Access to VC firms' team tabs to see active partners of the fund & their LinkedIn

-

Navigate a VC's portfolio to see relevant portcos or competitors, quickly find their founders on LinkedIn to connect with them, and request warm introsA downloadable CSV with the investor emails & LinkedIn URLs

- Ability to filter your matches and adjust your profile

-

LiteCRM to track your progress

-

Request intros to VCs directly through the platform

- Get our fundraising guide on how to increase your odds of getting a meeting

- Upgrade to lifetime access (one-time fee of $497) and get a free coaching session

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc

.png?width=381&height=214&name=EP%2034%20Alon%20Talmor%20YT%20Thumbnail%20(revised).png)