What's Below in Issue #63:

📰 - A look into Thunder's Advisor Strategy

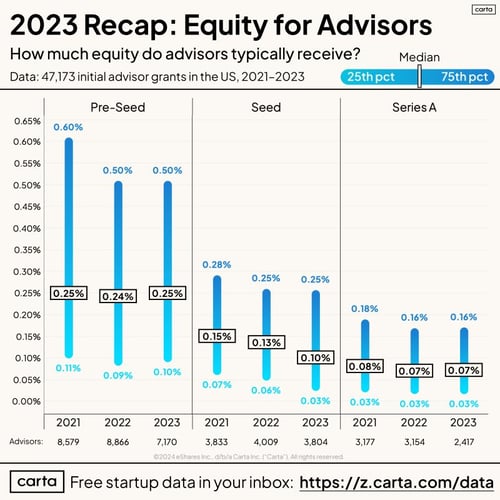

📊 - Data behind advisor equity compensation

🎙️- Podcast w/ Vlada Lotkina

💵- Premium startup resources

🆓- Free startup resources

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Have revenue and need access to quick capital?

The cost of equity capital is getting expensive; debt or working capital might be a better option if you're already generating revenue, and it's non-dilutive.

We've made it easier than ever to get matched with private capital providers and receive offers in minutes, not weeks or months.

*We don't charge any fees to source you debt*

------------------------------------------------------------------------------------------------------------------------------------------------------------

Choosing the Best Advisors and Avoiding Charlatans

People are great at having opinions on every topic (myself included 😅), even when they know nothing about it. The same goes with advisors, many more people claim to be valuable than truly are. We will try to help you find those with real value and avoid the ones masquerading as “top startup experts.”

The goal of the Advisor

The goal is simple: To keep you from making mistakes by leveraging their experience, knowledge, and network.

However, everyone has different needs for their advisor. You might be a domain expert but need a network in the industry you are building, which an advisor can fill. You might be a great businessman but need someone with area expertise to fill in your gaps. You might need someone who can mentor you on building a successful SaaS startup since you have only built hardware startups before. There are many reasons you could want an advisor, but it all boils down to setting a clear goal and managing the expectations of both parties upfront.

Some advisors come with extra benefits such as reputation and influence. For example, if the advisor is well known in the space, then having them as an advisor can signal to others to take your startup seriously. It can help in the fundraising process and build business relationships. Others are influencers and bring lots of attention to companies they work with. Many founders try to find these types of advisors first. However, we recommend viewing this type of “advisor” as a marketing strategy and it often leads to the least successful engagements..

When thinking about the type of advisor you need, consider the following areas:

- Knowledge. Is there a specific area you need expertise in for the next 2+ years? This is not something you need temporary expertise in – that is meant for consultants. For example, if your app stores sensitive data, it is a good idea to hire an expert in data security compliance, but it is unlikely you will need that expertise regularly for many years.

- Connections. Do you need specific introductions? Mentors are great for helping create these meetings. However, it is important to know how well the mentor knows the players. Just a LinkedIn connection is not impressive, but a longtime friend is.

- Company Building. If you need help building your company, make sure the advisor has built a similar type of company in the sector, revenue model, and exit you are looking for.

Have a strong idea of what you are missing and need in an advisor. In many ways, it is like looking for a cofounder, except they will be dropping in now and then, instead of building with you every day.

Finding the best advisors

A great rule is: if they ask to be an advisor, run away!

As an early-stage founder, tens of people will be offering their services and claiming to be “expert startup advisers.” However, most of them will be completely useless, a time suck, or worse a blackhole for precious equity. It is important to know what you need; it will help you reject the majority of the “experts” off the bat.

The key traits of a great advisor are:

- Problem solving. It is great to be an expert in an area, but if you can’t apply it to new scenarios, then the knowledge is useless. Startups are always solving problems, and the advisor needs to fit that mind space.

- Communication. Many companies will joke that the role of middle managers is to interpret what the brilliant engineers in a company mean to higher management. Yet, you need to make sure that the advisors you work with can communicate clearly and effectively about the subject matter they know. Having the top expert in your space is not useful if they can’t explain their knowledge to people without a PhD.

- Enthusiastic. They need to LOVE your idea. If they don’t love it, it’s not a good idea to take them on board. You want your startup to be something they will dedicate time to without even being asked.

- Available. Even if someone is the leader in your space and loves your idea, if they have no time for you, then they can’t advise. This will change for each founder in terms of how much time they want from each advisor. However, advisors who can only meet for 15 minutes every other month are never a great fit.

- Personality. Advisors should be like cofounders. You should enjoy spending time together. Advisors can play a much better role when the relationship is based on friendship than a contract. Usually, this will be paired well with low-ego personalities. They will want to help you because they care about your idea.

Thunder Advisor Strategy

We have a specific strategy for vetting potential advisors that we would like to share with you. It centers around vetting advisors by testing them before bringing them on board.

- Patience. Finding the entire board of advisors is not something that can be done in a single month or even a year. It takes patience to find great advisors and should be done one at a time. Additionally, your needs will change as the company grows. It is a good idea to leave space for new advisors that match those needs when the company reaches that stage.

- Identify advisors. Based on the areas of need, you can look for people who can fit that specific need. The easiest is if you have a mutual connection to create the introduction. However, even a cold email can work well. This part is about looking for who you THINK can be a good fit - you have not tested them yet, and will want to do some reference checks to be on the safe side if they're outside your trusted network.

- Don’t ask to be an advisor. Contrary to what many say, we recommend building the relationship around friendship and interest in your startup. When you reach out, tell them that you want to discuss your idea and ask them a few questions. Don’t mention anything about being an advisor. Your goal is to measure how interested they are in your startup and willingness to engage. The conversation should flow easily if they are an expert in your space since they should have important information and opinions for you to consider.

- Stay in Touch. If the meeting goes well and they love your idea, ask them if they are ok with you asking them questions now and then. People who want to be helpful and have low egos should be more than happy to stay in touch if they love your idea. You can now treat them as an informal advisor, and you should reach out to them about 1-2 times per month with a question. Your goal is to see how helpful and engaging they are over the next 3-5 months.

- Red Flag. If the person immediately asks for equity to stay in touch, then it is probably not a good fit. Every founder should make their own judgment on how to handle this situation. However, we find that advisors who are hungry for equity tend to care more about having stakes in early-stage startups than helping build them. The most helpful advisors are the ones who engage because they love your idea. Don’t feel bad about saying no. There are so many other potential advisors that it is best to move to the next person.

- Bringing them on Board. Now you have found someone who loves your company, has been extremely helpful over the past few months, and see lots of potential value over the next few years, it is time to bring them on board. You should create an advisory contract for them that gives them equity (or payment - based on their preference) in exchange for specific items that you need. We recommend the FAST Agreement.

Compensation

It is difficult for most founders to gauge how much equity to give advisors. However, it is generally between 0.1% - 0.6%, depending on how valuable you see the relationship. Some advisors will prefer cash and that will be a personal discussion between the CEO and advisor.

The biggest advantage of following the Thunder strategy is that the advisor has already proven their value and interest. This means there is often less of a need to build legal protections such as cliffs into the contract.

Relevant Articles for Finding Great Advisors

- Building your startup advisory board- 👉 SVB

- How to find great advisors for your startup (and avoid the shit ones) - 👉 Medium

- 7 Tactics to Get the Most Out of Your Startup's Advisors - 👉 The Review

-------------------------------------------------------------------------------------------------------------------------------------------------------------Data Corner

How much to pay advisors

If you want data on how much equity founders pay advisors, this graphic from Carta is helpful to visualize the average. While the amount has dropped slightly over the past 3 years, it has remained quite consistent. It is important to remember that as your company matures, the equity reward shrinks.

-------------------------------------------------------------------------------------------------------------------------------------------------------------Fundraising Demystified Episode #31 is Live!

.png?width=600&height=338&name=Fundraising%20Demystified%20%20Youtube%20Thumbnail%20(3).png)

In this episode, Vlada Lotkina, founder of ClassTag, shares valuable tips for first-time founders and fundraisers on successfully raising funds in a difficult category - education.

She covers strategies for scaling ClassTag's user base to 5 million teachers and parents, convincing investors who initially said no, and selling the company smoothly after raising $12 million in venture capital.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

🤓 - Free pitch deck reviews - Submit your deck

💸 - Access working capital fast - Explore options for free

😍 - Free list of AI Recommended VCs - Apply for free

👨💻 - Free fundraising coaching session - Schedule 15 minutes with us

Premium Resources

Your pitch deck built by VCs and designers

🗓️ - Book a one-hour private capital strategy call - Book Now

💫 - Pitch deck design services for founders by VCs - Decko

💼 - Startup Legal Services - Bowery Legal

📚 - Startup Friendly Accounting Services - Chelsea Capital

Upgrade to Thunder Premium to Unlock:

- Access to VC firms' team tabs to see active partners of the fund & their LinkedIn

-

Navigate a VC's portfolio to see relevant portcos or competitors, quickly find their founders on LinkedIn to connect with them, and request warm introsA downloadable CSV with the investor emails & LinkedIn URLs

- Ability to filter your matches and adjust your profile

-

LiteCRM to track your progress

-

Request intros to VCs directly through the platform

- Get our fundraising guide on how to increase your odds of getting a meeting

- Upgrade to lifetime access (one-time fee of $497) and get a free coaching session

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc

.jpg?width=381&height=214&name=The-Truth-About-Crowd-Equity-Campaigns%20(1).jpg)