Hey,

This is a special one. After 2 years, I made it to 100 issues of the Fundraising Demystified newsletter! Taking this time to reflect.

Also;

📸 - Social Snapshot- Hitting your goals

📊 - Dilution with SAFEs

🎙️ - Episode 64: The surprise seed round with Alexandria Procter

🆓 - One of my fave resources- the guide to your nailing your 1st investor calls

Let's get into it.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Want a Fundraising Audit?

Not sure why investors are passing? Want to know the answer? Are you based in the US, Canada, or the UK?

Book a discovery call with us we will give you the answer you're looking for and help you get on the right path for your business.

Full disclosure, it might take more than a 20min call to give you an exact answer, but we have to start somewhere.

-------------------------------------------------------------------------------------------------------------------------------------------------------------Social Snapchat

🏆 Reaching your goals by Alex Hormozi on X.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Episode 64: From Student Housing Startup to Africa’s Largest Platform with DigsConnect's Alexandria Procter

On the podcast last week was Alexandria Procter, co-founder of DigsConnect- a South African PropTech.

Alexandria shares more about raising Africa's largest seed round at the time, and transitioning from CEO, to CTO, to author.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Data Corner

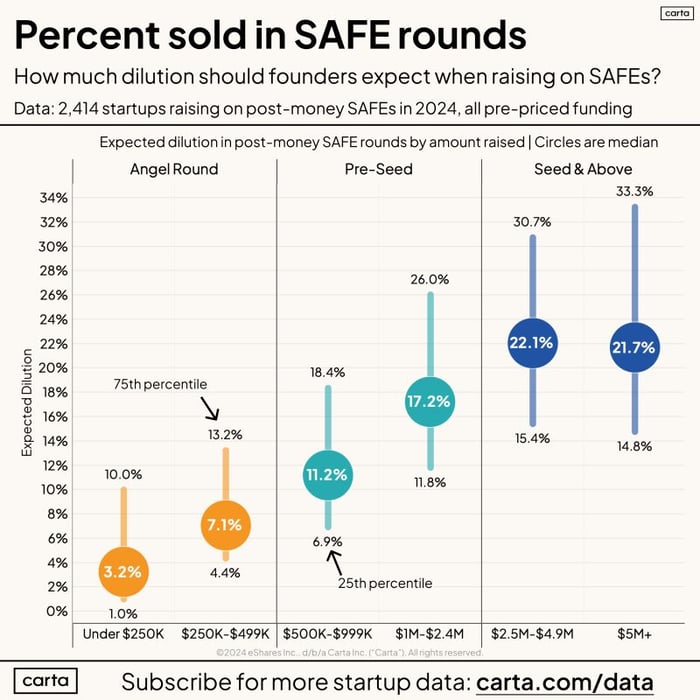

Dilution in SAFEs

Raising a SAFE before year-end? According to the folks at Carta, here’s the deal:

- Bigger round = bigger slice of your company sold.

- SAFEs are all over the map—way more variation than priced rounds.

Experienced founders get better deals (because of course they do).

Median dilution by round:

- <$250K: ~3.2%

- $500K–$999K: ~11.2%

- $2.5M–$5M: ~22.1%

SAFEs don’t convert until the priced round, but these numbers give you a ballpark.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Raising Capital for your startup?

Thunder's mission is to guide founders toward the right path to reach their North Star, be it through securing equity or debt financing or navigating the path to a successful exit.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

100 Issues of Fundraising Demystified

When I sat down to write the very first issue of Fundraising Demystified (the evolution is obvious), I didn’t know where it would lead. I knew I had a lot to say about raising capital, navigating exits, and what happens after you’ve "made it." Now, 99 editions later, I’m still at it. Still trying to make the world of fundraising less intimidating (and maybe a little less frustrating) for founders.

So why did I start Thunder?

Because I failed in my first true startup. I thought I was venture-backable; I thought our product was the best in class and that every investor would love. The reality was, in hindsight, we were a small idea in a small market, but no one told me that and I was chasing down VCs with the wrong product. Had I focused on building a profitable business and just doing an angel round, we probably wouldn't have shut down.

No one wanted to tell me the truth and snuff out my ambitious flame. But I wish they had.

Fortunately for me, I went on to bigger and better companies. After raising money, selling companies, and hitting that weird "post-exit founder paradox" I wondered "What's next?"

I realized something: I loved two things from my experiences—working with founders and talking to capital allocators. And I wanted to spend my time doing both. I wanted to help founders navigate the right capital path for them and not have them fall into the same traps I did.

That’s how Thunder was born: a way to bridge the two worlds I love and, ideally, make it easier for founders to reach their potential.

So that's how it started. And, here's how it going:

- We’ve hit over 12,000 subscribers to this newsletter. If you’re one of the day ones—thank you. If you’re new here, welcome aboard!

- The Fundraising Demystified Podcast launched and just crossed 1,000 subscribers on YouTube. Listening to my recorded voice is still weird 65 episodes later, but the conversations make it worth it- if you haven't already, check it out.

- The team at Thunder has doubled in size (it turns out, capital strategy takes a village).

- And most importantly, Thunder has supported 400+ companies that have gone on to raise a collective $1.2B+. That kind of number that makes me sit back and think, Okay, we’re doing something right.

So, what’s next for Thunder? The same thing we’ve been doing—helping founders through fundraising and hopefully making it just a bit easier. I hope that we’ll continue to grow, support even more founders, and hit a few more milestones worth celebrating.

We will continue to offer free tools to support founders, so share the newsletter with anyone who might be looking to raise it soon. We recently updated our product, but we're looking forward to more innovation next year.

Thank you for being part of this journey—whether you’re a founder we’ve helped, a subscriber who opens this newsletter every week, or someone who’s just starting out. Here’s to the next 100 issues.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Happy with Fundraising Demystified?

Let me know how you like the newsletter (it will only take a minute). Any topics you'd like me to cover? Click below and share.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

That very first call with an investor could make or break your relationship. Find out how to get that all-important second call on your way to funding here:

📞 The guide to nailing your first investor call- Download it Here

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc