Hey,

In this week's issue, I want to share some tips on how to get funded by building the right investor list, backwards, It worked for me, so hope it works for you too.

Also;

📸 - Social Snapshot- is AI taking on devs or startups?

📊 - Private Equity's ups and downs

🎙️ - Partial acquisitions with Laurits Just

🆓 - Negotiate your term sheets like a pro

Welcome to issue 108.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

How Much Could You Sell Your Company For?

If a private equity firm or strategic acquirer made an offer to you today, would you take it? Would you know if it's a fair deal? Are you in the position to close a deal?

Getting acquired could transform your life.

Founders don't realize that it usually takes 12-24 months to prepare a company for a successful exit, the sooner you have a plan in place, the greater the potential outcome.

If you want to get acquired, we can help. Book a free discovery call with our team of experts to explore your options and discuss getting a plan in place that could change your life.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Social Snapshot

❓Is this the future for devs and startups by Marc Lou on X.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Exiting Strategies and Alternative Capital Fundings with Laurits Jus of Flippa Invest - EP 72

In the latest episode of the podcast, I spoke to Laurits Just, CEO of Flippa Invest, a marketplace for partial and full business acquisitions. Laurits shares how he built and sold his startup, a marketplace for partial business acquisitions, and why he ultimately chose to exit instead of raising venture capital. Tune in!

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Data Corner

PE's Step Ups

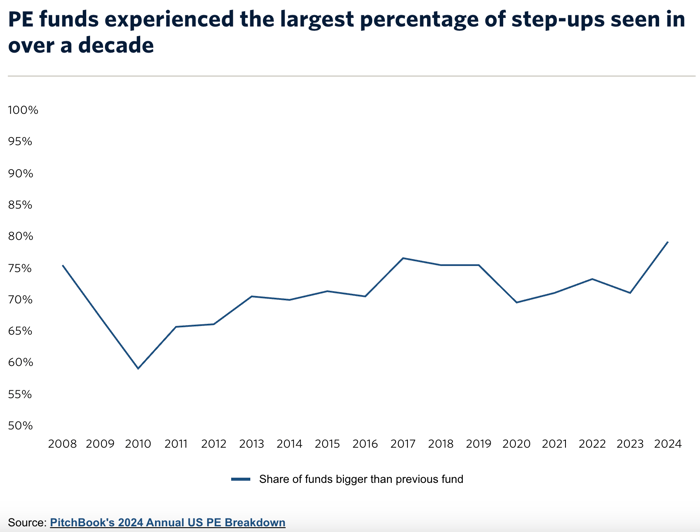

Private equity fundraising in 2024 was brutal. With exits stalled, LPs weren’t getting returns from older funds, leaving them with less cash to commit. Total PE fundraising is expected to land above $300B—far below 2023’s $395B.

Raising took longer too, with funds closing in 16.2 months on average, up from 13.8 months in 2023. The winners? Big-name firms with mega-funds ($5B+), which made up 43.7% of all capital raised. If you weren’t a giant in PE last year, fundraising was a slog.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Raising Capital for your startup?

Thunder's mission is to guide founders toward the right path to reach their North Star, be it through securing equity or debt financing or navigating the path to a successful exit.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

How to Reverse Engineer an Investor Pipeline That Actually Closes

I've seen lots of founders building their investor pipeline like a bad sales funnel: too many leads, not enough qualifiers, and zero strategy. They spray and pray, hoping a random VC bites. And then wonder why they get ghosted.

Let’s fix that.

Raising capital isn’t just about talking to investors, it’s about closing them. And the best way to close investors is to start with the end in mind. Here’s how to reverse engineer your pipeline so you’re not just collecting ‘maybes’ but landing real term sheets.

Step 1: Define your ideal investor, and be brutal about it

Not all capital is good capital. You don’t just need an investor; you need the right investor. The founder who raises successfully isn’t the one with the most meetings, it’s the one who focuses on the best fit.

Ask yourself:

- Do they invest at my stage? (If you're pre-revenue and they only do growth rounds, move on.)

- Have they invested in my sector? (Generalists are fine, but relevant capital closes faster.)

- Do they lead rounds, or do they follow? (If you need a lead, don’t waste time pitching followers first.)

- What’s their check size? (If you need $5M, pitching $250K investors is a distraction.)

- Are they actively deploying? (A lot of VCs "meet founders" when they’re not writing checks.)

If they don’t check these boxes, they don’t go on your list. Period.

Step 2: Work backward from the close

Once you know who should invest, your job is to map out the journey to a signed term sheet. Here’s a simple framework:

- Close: Who writes the check? What do they need to say “yes”?

- Late-stage Buy-in: Who else in the fund needs to approve this deal? (Partners? IC? LPs?)

- Mid-Funnel Conviction: What objections do they need to overcome before committing?

- Early Interest: What sparks their initial interest? Warm intro? FOMO? Market tailwinds?

Most founders spend too much time pitching at the wrong stage when investors are just sniffing around. You need to nix objections early, build conviction fast, and get buy-in before the decision-makers even see your deal.

Step 3: Prioritize warm intros over cold outreach

Yes, cold emails can work. But warm intros work better. You want to land in an investor’s inbox with credibility already attached.

- Use your existing investors, advisors, and founder network. (VCs trust recommendations from people they’ve backed before.)

- Find mutual connections on LinkedIn or Twitter and ask for an intro. (Don’t just say, “Can you intro me?”, give them a reason.)

- Go through their portfolio founders. Investors respect founders they’ve already funded. If you can get a vouch from one, you’re golden.

If you do go cold, be hyper-specific. “I saw your investment in X, and here’s why my company is relevant” works 10x better than “Would love to connect.”

Step 4: Create urgency without sounding desperate

VCs move in herds. No one wants to be first; everyone wants to be last. Your job is to create FOMO.

- Leverage momentum. Got a lead investor? Say it. Hitting new traction milestones? Share them.

- Set clear timelines. “We’re closing in 30 days” forces decisions.

- Use social proof. If a top-tier VC is showing interest, others will follow.

If you just “keep investors updated,” you’ll get slow maybes. If you show momentum and a closing window, you’ll get faster yeses.

Step 5: Cut the Dead Weight

Too many founders hold onto maybes hoping they turn into yeses. They rarely do.

- If an investor isn’t engaging after two follow-ups, move on.

- If they keep saying, “We’re interested, but let’s check in next quarter,” move on.

- If they ask for more data but never make a decision, move on.

Fundraising isn’t about getting the most conversations, it’s about closing the right ones.

It’s a numbers game, but not how you think

You don’t need 200 investor meetings. You need the right 20-40 in your pipeline (30 was my golden number), 5-10 in serious diligence, and 1-2 term sheets to win.

Fundraising is a sale. And in sales, the best closers don’t chase every lead. They chase the right ones.

Go build a pipeline that actually closes. Happy building, and check out the term sheet negotiation playbook below for when you land those deals!

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Happy with Fundraising Demystified?

Let me know how you like the newsletter (it will only take a minute). Any topics you'd like me to cover? Click below and share.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

As you set goals for the new year, here's my guide to planning out your fundraising over 12 months:

🗓️ Your 12-month fundraising plan- Download it here

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc