Hey,

This week I want to share some thoughts on founder branding: how do you need to position yourself pre-fundraise

Also;

📸 - Social Snapshot- Lack of PMF

📊 - Co-founder exits

🎙️ - Founders who raised over $25M share their tips

🆓 - Nailing your 1st calls with investors

Welcome to issue 101

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Want a Fundraising Audit?

Not sure why investors are passing? Want to know the answer? Are you based in the US, Canada, or the UK?

Book a discovery call with us we will give you the answer you're looking for and help you get on the right path for your business.

Full disclosure, it might take more than a 20min call to give you an exact answer, but we have to start somewhere.

-------------------------------------------------------------------------------------------------------------------------------------------------------------Social Snapchat

Tips on product from Kevin Jurovich on X

-------------------------------------------------------------------------------------------------------------------------------------------------------------

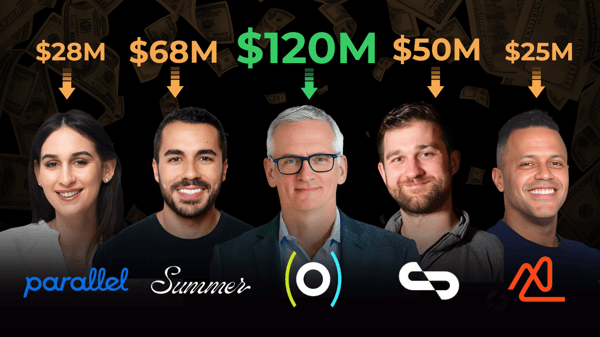

The 5 Best Fundraising Stories of Founders Raising Over $25M

This week we put together a recap from the top 5 founders who have raised over $25M.

Listen to folks, including Chris Gladwin whose company was acquired for $1.4B by IMB, share their fundraising journeys.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Data Corner

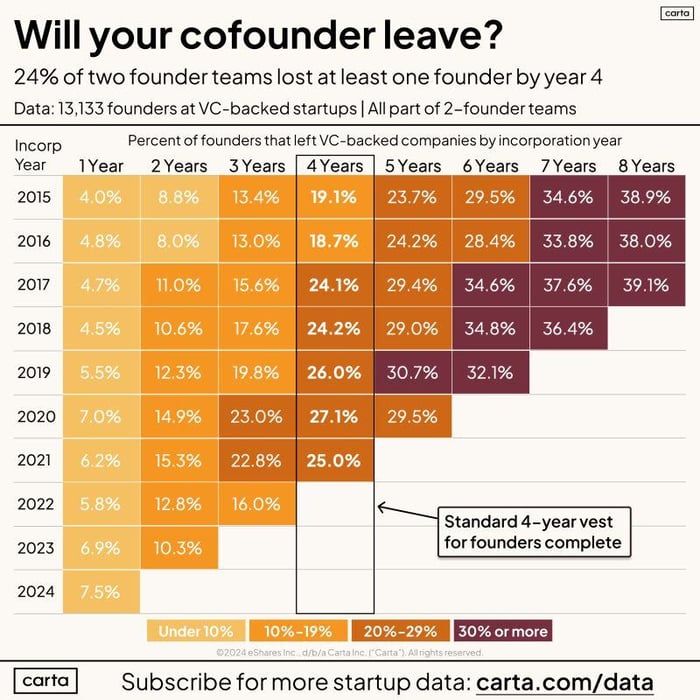

Will your co-founder leave?

By year four, 1 in 4 VC-backed founders will have left their startup—a pretty standard part of the game.

From 13,133 US startups on Carta, (2015–2024, VC-backed, 2 founders), here’s what they saw:

- Early departures (year one) are becoming more frequent.

- The 2022–2023 downturn pushed up founder exit rates for pre-bust startups.

- About 25% of founders don’t stick around for their full 4-year vest.

Building a startup is a lot like a marriage, which is why solid vesting schedules are non-negotiable—protect yourself and your team.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Raising Capital for your startup?

Thunder's mission is to guide founders toward the right path to reach their North Star, be it through securing equity or debt financing or navigating the path to a successful exit.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Founder Branding

This week's topic may make you feel a bit cringe: branding yourself. Yeah, the idea of treating yourself like a walking, talking startup might feel like an identity crisis waiting to happen. But if you’re planning to raise capital in the next 6-9 months, building a personal brand isn’t just nice to have—it’s opening doors to deals.

It's been said a lot, investors don’t just invest in businesses; they invest in people. The more magnetic, credible, and approachable you are as a founder, the more likely they are to give you their time (and their money). Personal branding is the art of controlling your narrative so investors hear what you want them to hear. Done right, it’s basically your pitch deck in human form.

What Does "Founder Branding" Mean?

Founder branding is the sum of everything you’re putting out into the world—your LinkedIn posts, media appearances, podcasts, panel talks, and even your company updates. It’s the intersection of your expertise, your personality, and the story of your company.

You need to turn into the next Gary Vee overnight. But it does mean showing up consistently, offering value, and making your journey relatable.

Rahul Vohra nailed this. Before Superhuman raised over $33M in funding, Rahul crafted a founder narrative that screamed “visionary.” He didn’t just sell an email tool; he sold the idea of reclaiming time and achieving flow state. On LinkedIn and in interviews, he spoke about his mission loads. Investors couldn’t help but take notice.

What you need:

- A Clear Narrative

Why did you start your company? What problem are you solving? And, more importantly, why are you the one to solve it? Think of this as your origin story—investors love a good hero’s journey. - An Active Online Presence

You don’t have to be on every social media platform, but LinkedIn is non-negotiable these days. Share lessons learned, insights about your industry, or even small wins along the way. Just remember: investors are lurking, so post like they’re reading (because they are). - Thought Leadership

Write that Medium article. Jump on a podcast. Speak on a panel. The goal is to position yourself as someone who deeply understands your space and has the chops to build a category-defining business. Also, while it's tempting to use ChatGPT to write stuff for you, try to inject more relatable insights and your own. tone. - A Sprinkle of Personality

Nobody wants to fund a robot. Be human, be funny, be honest. Your quirks are what make you memorable. Personally, I know my brand is blunt/direct but that works for me. Figure out what works for you.

Recently seen the reintroduction trend on LinkedIn where people post about who they are, their story, and their products. This is an easy first step to building your founder brand. Jump on it.

Branding isn’t about being someone you’re not; amplify the best of who you already are.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Happy with Fundraising Demystified?

Let me know how you like the newsletter (it will only take a minute). Any topics you'd like me to cover? Click below and share.

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

That very first call with an investor could make or break your relationship. Find out how to get that all-important second call on your way to funding here:

📞 The guide to nailing your first investor call- Download it Here

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc