What's Below in Issue #65:

📰 - A look into Running an effective board Meeting

📊 - Data behind the rise in M&A for small startups

🎙️- Podcast w/ Tyler Denk, founder of beehiiv

💵- Premium startup resources

🆓- Free startup resources

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Have revenue and need access to quick capital?

The cost of equity capital is getting expensive; debt or working capital might be a better option if you're already generating revenue, and it's non-dilutive.

We've made it easier than ever to get matched with private capital providers and receive offers in minutes, not weeks or months.

*We don't charge any fees to source you debt*

------------------------------------------------------------------------------------------------------------------------------------------------------------

Running an Effective Board Meeting

Board meetings are either a great experience for founders or complete hell. However, most of the time, at the early stage, founders have anxiety when thinking about the next board meeting. You need to present how well you are leading your company to the people who have the power to fire you. That’s quite stressful, especially because 50% of founders are no longer CEO by year 3, and less than 25% make it to IPO.

How can a board meeting be impactful when there is a deep-seated fear of the people across the table?

The answer lies in letting go of the fear of accepting the help the board can offer. Founders are always limited if they work based on just their own ideas. To have the best ideas, you need to discuss with the best in class - usually the same people who are on your board. They have seen hundreds of similar companies and can help you navigate difficulties you have never seen before.

In this article, we will help you prepare to make the most of your board meeting.

Creating the Board

The process starts with building your board. For the first few funding rounds, it will almost always be founders and investors. This is why founders must choose carefully who they take as the lead investor. That person will be on the board, impacting the room dynamics at the meetings.

An option that is rarely used, is placing a trusted mentor into the elected seat. If you are given an extra seat to fill at the table, having someone that you know very well fill that seat can help the other board members understand how you work. When you present, the mentor will naturally guide the other board members in interpreting your presentation.

Frequency of the Meeting

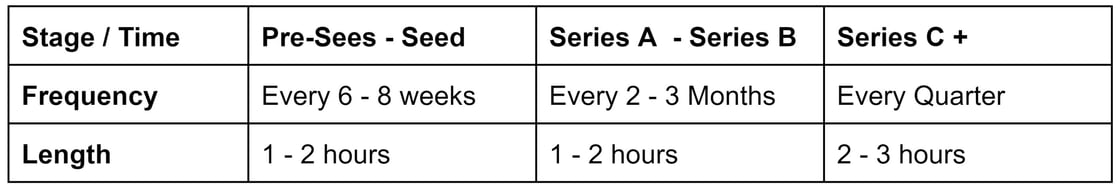

Board meetings are short and more frequent at the early stage, and become longer as your company becomes bigger.

Here is a general idea of what you should plan for:

Preparing for the Meeting

As with any meeting, preparation is everything. You should have an agenda for each meeting and pre-meeting documents for board members to read beforehand. Building a system with templates can make this entire process only a few hours and relatively stress-free.

What you need to prepare:

- Pre-meeting documents. This should include your agenda and details about the company's performance that will help the board members have a better context to address issues during the meeting.

- Distribute about 72 hours in advance. This gives everyone enough time to review them, but also not too long for them to forget.

- Allow for Comments. While PDFs are great, creating an online version that board members can comment on allows you to clarify details in advance so that the meeting itself can be streamlined.

- Agenda. This should be very simple and only include a few discussion points. Try focusing on 2 - 3 key items for discussion at each meeting. More than that will either take too much time or be difficult to facilitate good discussion.

- Introductory remarks. The first 20 minutes is usually a broad overview by the founder on how the company is running. Make sure to prepare the details so you can give specific metrics and discuss fine details if asked.

- Detailed points for the 2 - 3 items. Unlike you, the board members are not involved with the daily functions of the company. They will need you to provide them with all the detailed information to help you come to good conclusions about the issues you would like to address.

- Senior management. It is a good idea to have your senior management team be involved with the board since it motivates them and allows them to feel more included in decisions. They don’t need to attend every meeting or even the entire meeting. However, it is often helpful to have the person most directly involved with the points you are raising prepare a short presentation to the board about the topic.

- Note Taking. Every board meeting needs to have minutes to document what you discussed and what was voted on. Have a plan for who (and with what software) will be doing that.

Conducting the Meeting

Some important tips for running a great meeting:

- Start on time! The tone for your board is set at the first meeting. If you start late then board members will never come on time in the future. It is much better to start without everyone there and set the tone that you plan on always starting exactly on time.

- End on Time! This will require great time management skills, which we will discuss later. If you run over the end time, people will drop off the meeting and you will not get the definitive decisions you need.

- Keep your board members responsible. If you have a clear expectation that they read the pre-meeting materials, then they will make sure to review them before the next meeting. If the assumption is that you will review those numbers anyway, then no one will look at them in advance. It is all about how you set the tone of the meeting.

- Focus on the future. The biggest mistake CEOs make is to spend most of the meeting on past performance. It is easy to fall into this trap since all you want to do is justify your ability to execute to the board (and avoid being fired). The problem is that you aren’t leveraging the best tool you have to build the company. The goal of the board is to strategize for the future. You chose the people on the board because they have the expertise to guide your company - use them to plan the next steps.

- Leave your ego at the door. Being able to take constructive criticism from your board is a valuable skill that will build trust and respect for you as a leader. The board wants to help, but can only do so if you are open to hearing feedback.

- Make sure to vote. If you have a decision that requires a vote, avoid letting the discussion flow on for too long without getting a concrete vote from the board. Everyone will have an opinion, but if you don’t facilitate or mediate the conversation, it is easy to let the conversation run to the end of the meeting.

Post Meeting Summary

Since you followed the preparation tips and have great meeting notes, it is very easy to send them to the board members to summarize what you discussed and voted on.

It is also good practice to share a redacted version with senior management to update them on what happened. You don’t need to tell them all the details. However, sharing a summary will let people feel more involved and build a higher trust. No one likes secretive meetings behind closed doors.

Relevant Articles for Running a Board Meeting

-

How To Run An Early-Stage Board Meeting- 👉 NfX

- The 10 Keys to A Successful Board Meeting: How to Make Them Great and Not Something Everyone Dreads - 👉 Bain Capital Ventures

- Managing a Series A board meeting - 👉 Unusual Ventures

-------------------------------------------------------------------------------------------------------------------------------------------------------------Data Corner

.png?upscale=true&upscale=true&width=600&height=337&name=unnamed%20(3).png)

Rise in M&A for small startups

While M&A has overall dropped in 2023 compared to 2022, it is still much higher than 2019 - 2020 levels. What is most interesting is the rise in activity for very small startups. While there has been stagnation in larger firms completing M&A, smaller startups are still able to find exits.

-------------------------------------------------------------------------------------------------------------------------------------------------------------Fundraising Demystified Episode #33 is Live!

-1.png?upscale=true&upscale=true&width=600&height=338&name=Fundraising%20Demystified%20%20Youtube%20Thumbnail%20(3)-1.png)

In this episode, Tyler Denk, a self-taught software developer turned CEO of Beehiiv, a newsletter publishing platform, shares his story on how he built a product from scratch into a multi-million dollar company. From teaching himself to code to navigating the complexities of startup growth and securing a $12.5M Series A and reaching $7M annual recurring revenue, he's got cheat codes to fundraising for startup founders.

Here's what you're in for:

- 00:00 - Intro

- 04:35 - Transition from Morning Brew to Google to Beehiiv

- 17:49 - Raising $2.6M in seed round 27: 35 - Hitting $7M ARR

- 37:26 - Current state and future plans

- 44:05 - Tyler's cheat codes and advice for fellow founders

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

🤓 - Free pitch deck reviews - Submit your deck

💸 - Access working capital fast - Explore options for free

😍 - Free list of AI Recommended VCs - Apply for free

👨💻 - Free fundraising coaching session - Schedule 15 minutes with us

📝 - Playbook for Negotiating Term Sheets - Download it Here

💽 - Playbook for Setting Up and Sharing Your Data Room - Download it Here

✉️ - Playbook for Sending Investing Updates - Download it Here

Premium Resources

Your pitch deck built by VCs and designers

🗓️ - Book a one-hour private capital strategy call - Book Now

💫 - Pitch deck design services for founders by VCs - Decko

💼 - Startup Legal Services - Bowery Legal

📚 - Startup Friendly Accounting Services - Chelsea Capital

Upgrade to Thunder Premium to Unlock:

- Access to VC firms' team tabs to see active partners of the fund & their LinkedIn

-

Navigate a VC's portfolio to see relevant portcos or competitors, quickly find their founders on LinkedIn to connect with them, and request warm introsA downloadable CSV with the investor emails & LinkedIn URLs

- Ability to filter your matches and adjust your profile

-

LiteCRM to track your progress

-

Request intros to VCs directly through the platform

- Get our fundraising guide on how to increase your odds of getting a meeting

- Upgrade to lifetime access (one-time fee of $497) and get a free coaching session

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

- Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

- Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

- Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

- Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc