What's Below in Issue #59:

📰 - A look into how liquidation preferences impact founder exit returns

📊 - Data behind average cash raised and valuation for Seed raises in 2023

🎙️- Podcast w/ Paul Kromidas

💵- Premium startup resources

🆓- Free startup resources

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Have revenue and need access to quick capital?

The cost of equity capital is getting expensive; debt or working capital might be a better option if you're already generating revenue, and it's non-dilutive.

We've made it easier than ever to get matched with private capital providers and receive offers in minutes, not weeks or months.

*We don't charge any fees to source your debt*

-----------------------------------------------------------------------------------------------------------------------------------------------------------

Avoiding the Trados Tragedy: Understanding Liquidity Preferences

Understanding Liquidation Preferences: Trados Case Study

Imagine starting a company, building a great product, building a customer base, and even being able to sell it for a nice $60M, only to walk away without a single penny. Yes, that’s the case of Trados and why knowing how liquidation preferences is important.

In this article, we will explain what liquidation preferences are, why they are important, and how they can affect the outcome of a startup exit. We will also discuss the different types of liquidation preferences and how they work in different scenarios. Finally, we will look at the case of Trados, an extreme example of how liquidation preferences can result in a negative outcome for the founders and employees, and why they should be careful when negotiating them.

Understanding Types of Liquidation Preferences

Liquidation preferences are terms that determine how the proceeds from a sale of a company are distributed among the investors and founders. They are one of the most important and complex aspects of venture capital financing, and they can have a significant impact on how much money each party receives, especially if the sale price is lower than the total amount invested.

While not the topic of this article, it is important to understand dual-class stock structure. If you want to know more about the topic, you can learn more here.

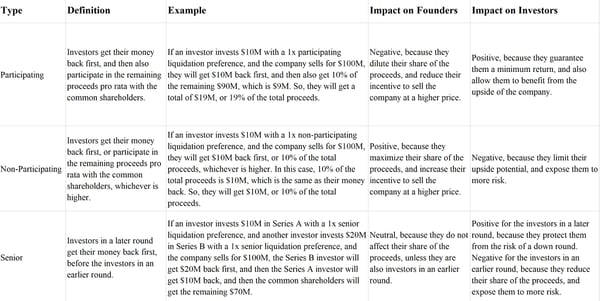

Types of Liquidation Preferences

Liquidation preferences are usually expressed as a multiple of the original investment, such as 1x, 2x, or 3x. For example, if an investor invests $10M with a 2x liquidation preference, they will get $20M back before anyone else gets anything.

There are three main types of liquidation preferences: participating, non-participating, and senior. Each type has its own advantages and disadvantages, depending on the situation.

- Participating Liquidation Preferences: Investors get their money back first, and then also participate in the remaining proceeds pro rata with the common shareholders.

- Participating liquidation preferences are advantageous to the investors, because they guarantee them a minimum return, and also allow them to benefit from the upside of the company. They are disadvantageous to the founders, because they dilute their share of the proceeds, and reduce their incentive to sell the company at a higher price. Participating liquidation preferences are especially harmful to the founders in a low exit scenario, where the sale price is lower than the total amount invested. In this case, the investors will get most or all of the proceeds, leaving little or nothing for the common shareholders.

- Participating liquidation preferences are advantageous to the investors, because they guarantee them a minimum return, and also allow them to benefit from the upside of the company. They are disadvantageous to the founders, because they dilute their share of the proceeds, and reduce their incentive to sell the company at a higher price. Participating liquidation preferences are especially harmful to the founders in a low exit scenario, where the sale price is lower than the total amount invested. In this case, the investors will get most or all of the proceeds, leaving little or nothing for the common shareholders.

- Non-Participating Liquidation Preferences: Non-participating liquidation preferences are the most favorable to the founders, and the most unfavorable to the investors. In this case, investors get their money back first OR participate in the remaining proceeds pro rata with the common shareholders, whichever is higher.

- Non-participating liquidation preferences are advantageous to the founders, because they maximize their share of the proceeds, and increase their incentive to sell the company at a higher price. They are disadvantageous to the investors, because they limit their upside potential, and expose them to more risk.

- Non-participating liquidation preferences are advantageous to the founders, because they maximize their share of the proceeds, and increase their incentive to sell the company at a higher price. They are disadvantageous to the investors, because they limit their upside potential, and expose them to more risk.

- Senior Liquidation Preferences: Senior liquidation preferences are the most favorable to the investors in a later round since it protects them from a down round, and the most unfavorable to the investors in an earlier round. They mean that the investors in a later round get their money back first, before the investors in an earlier round because it increases their risk of having no return in an exit.

- The seniority of a note does not influence their ability to participate or not. It only impacts their investor’s ranking in having their investments paid out.

Risks for Founders

Founders and employees are common shareholders, which means they will automatically be paid out after the investors. Multiple scenarios can create real problems for founders who are not careful:

- Impossible to make money. Having too many stacked and high liquidation preferences can create a situation where the founder can never exit and make money from their startup. For example, if a founder raises $200M with a 3x liquidity preference, the founder must exit at a valuation higher than $600M to receive any compensation. This can be very disheartening for founders when they have put so much effort into growing their startup and realize it will never benefit them financially.

- Investors want a quick exit. With a liquidity preference (especially with seniority), there is a misalignment between the founder and investors since the investors may want to sell quickly at a lower valuation that fills their liquidity preference but leaves nothing for the rest.

The Trados Case

The Trados case is an extreme example of how liquidation preferences can result in a negative outcome for the founders and employees, and why they should be careful when negotiating them.

Trados was founded in 1984 and provided computer software services to translate documents. During the 2000 internet bubble, Trados was worth $14M and on track to IPO, allowing them to raise more money over the next two years. After the bubble burst, Trados was still operating, but not to investor expectations. In 2005, the board voted to sell to SDL for $60M.

Investors invested $28.2M and received $49.2M. Management received $7.8M through a Management-Incentive Program (MIP) that was in place. The final $3M was spent on fees.

Investors walked away with almost all the money and common shareholders received NOTHING.

The investors owned preferred stock with 1x liquidation preference and an 8% cumulative dividend. When Trados sold to SDL, this right had grown to $57.9M.

One of Trados' early employees, Marc Christen, filed the class action lawsuit against the board claiming they violated their fiduciary duty to the common shareholders. However, after 11 years of litigation, the court concluded that the sale was at a fair price, there was no financial loss to the common shareholders, and there was no clear alternative that would have been better.

The case of Trados is quite scary for founders raising money from VCs and seeking the liquidation preference on the term sheet. It will be nearly impossible to remove it (almost every VC requires it). However, knowing the impact is critical to your ability to exit with personal gain down the road.

What can you do as a founder?

-

Avoid participating in liquidation preferences, or cap them at a certain amount or percentage.

-

Avoid multiple liquidation preferences, or limit them to a reasonable multiple, such as 1x (usually industry standard) or 2x.

-

Avoid senior liquidation preferences or make them contingent on certain milestones or performance. (Pari passu liquidation preferences are much better).

-

Seek a carve-out or a minimum payout for the common shareholders, or a bonus pool for the employees, in case of a low exit.

-

Seek a drag-along or a co-sale right, to have the option to sell the company along with the investors, or to veto a sale that is unfavorable to the common shareholders.

Relevant Articles to Liquidation Preference

- How Liquidation Preference Fuels Conflicts in Venture Capital - 👉 The VC Factory

- Liquidation Preference: Definition, How It Works, Examples - 👉 Investopedia

- What is a Liquidation Preference? - 👉 AngelList

-------------------------------------------------------------------------------------------------------------------------------------------------------------Data Corner

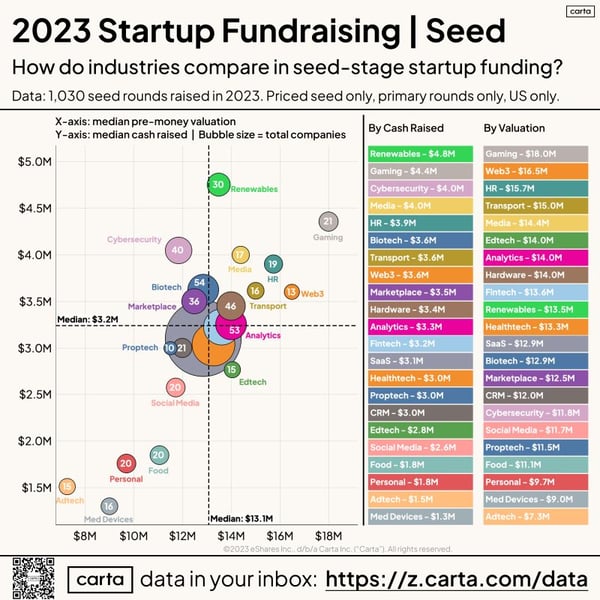

Know Your Industry Average

If you want to frustrate an investor easily, put a valuation on your company that does not closely resemble the market average. While every startup is unique, higher or lower multiples can be justified based on certain specific elements, in general, it is a good idea for founders to try and price their startup in line with the rest of their industry. Additionally, it is good to know how much other startups in your sector are raising on average - especially if you plan on asking for more.

-------------------------------------------------------------------------------------------------------------------------------------------------------------Fundraising Demystified Episode #27 is Live!

In this episode, we have Paul Kromidas, the mastermind behind Summer, a game-changing vacation home company that's turning heads with over $11 Million raised during their seed round, another $18 Million in series A, and a $50M debt facility.

We're talking practical empathy, perfect timing, and a killer structured process. Paul shares his insights and advice for founders on how to craft tailored narratives that speak directly to different investors and the importance of hiring the right experts.

A quick tip: If you're considering debt capital, Paul is the person you should listen to, as he has secured a $50 million debt facility for Summer Inc. Listen Here

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Free Fundraising Resources

🤓 - Free pitch deck reviews - Submit your deck

💸 - Access working capital fast - Explore options for free

😍 - Free list of AI Recommended VCs - Apply for free

👨💻 - Free fundraising coaching session - Schedule 15 minutes with us

Premium Resources

Your pitch deck built by VCs and designers

🗓️ - Book a one-hour private capital strategy call - Book Now

💫 - Pitch deck design services for founders by VCs - Decko

💼 - Startup Legal Services - Bowery Legal

📚 - Startup Friendly Accounting Services - Chelsea Capital

Upgrade to Thunder Premium to Unlock:

-

Access to VC firms' team tabs to see active partners of the fund & their LinkedIn

-

Navigate a VC's portfolio to see relevant portcos or competitors, quickly find their founders on LinkedIn to connect with them, and request warm introsA downloadable CSV with the investor emails & LinkedIn URLs

-

Ability to filter your matches and adjust your profile

-

LiteCRM to track your progress

-

Request intros to VCs directly through the platform

-

Get our fundraising guide on how to increase your odds of getting a meeting

- Upgrade to lifetime access (one-time fee of $497) and get a free coaching session

-------------------------------------------------------------------------------------------------------------------------------------------------------------

Let's stay in touch:

Written by Jason Kirby - https://www.linkedin.com/in/jasonrkirby

Subscribe to our weekly newsletter for market and industry news and tips when it comes to raising capital and growing your business - https://join.thunder.vc

Seeking to raise capital? Get your list of target VCs by creating a free profile here - https://web.thunder.vc

Looking to raise debt? Explore tailored debt options for free by completing a profile at https://debt.thunder.vc